(April 16): Asian technology stocks fell after Nvidia Corp said the US government will begin requiring a licence to export its H20 chips to China, an escalation of restrictions.

After the reprieve from President Donald Trump’s tariffs for electronics that boosted tech stocks on Monday, the latest curbs are a reminder of how the US-China trade war extends beyond import taxes. The fallout could weigh on chip-sector earnings and set back China’s ambitions to compete on the global tech stage.

The move is “driven by concerns over China’s rise in the electronics sector and, in that sense, it is likely to become a permanent policy”, said Tomo Kinoshita, global market strategist at Invesco Asset Management. “It is expected to have a significant negative impact on the semiconductor supply chain.”

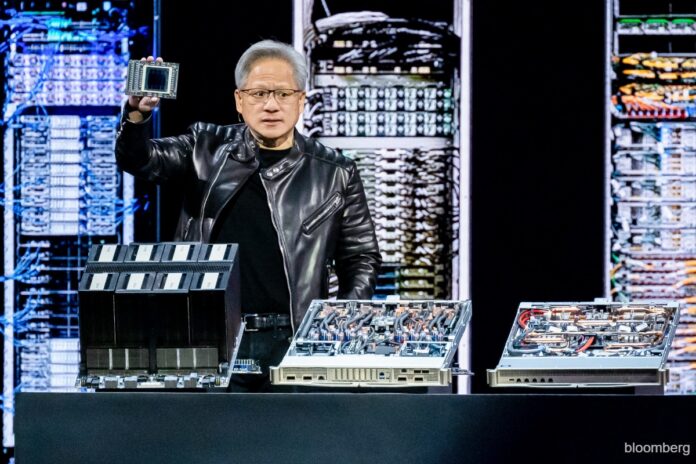

Nvidia warned that it will report about US$5.5 billion (RM24.26 billion) in related charges during the fiscal first quarter. Its shares slid about 5% in late US trading.

Among key suppliers, shares of Japanese testing equipment maker Advantest Corp dropped as much as 5.6% while those of Korean memory maker SK Hynix Inc slumped 3.7%. Nvidia’s top foundry Taiwan Semiconductor Manufacturing Co dipped 1.8%.

TSMC was already likely to slow some production expansion on a weaker economic outlook and “the tighter rules on Nvidia’s China sales might amplify the deceleration”, Bloomberg Intelligence analyst Ken Hui wrote in a note.

For China, the broader restrictions raise concerns that access to global tech hardware will be further choked off. Exports of the most advanced chips and equipment to the Asian nation are already banned and the H20 is a scaled-down product specifically designed not to be too powerful.

Even after DeepSeek raised hopes that advances can be made in artificial intelligence and other fields without the most cutting-edge chips, China’s tech giants may suffer if curbs keep getting extended. Alibaba Group Holding Ltd sank as much as 4.8% in Hong Kong trading Wednesday, while Baidu Inc fell 2.6%.

“It is a reminder of the potential susceptibility of tech stocks to the ongoing prickly relationship between the US and China regarding semiconductors,” said Tim Waterer, chief market analyst at KCM Trade in Sydney. “There is a reliance on the H20 chip from big-name players in the Asian tech space, so any moves which could impact supply will be a drag on the broader sector.”