In the past, Lim Yi Ying, a 35-year-old Singaporean business owner, could spend over S$1,000 (US$767) on Singles’ Day sales, even making repeat purchases without realising.

“During sales, or even when I’m bored, I would open shopping apps and scroll through and just find a reason to buy something – whether you need it, you will find a reason like it’s cheap or on offer or the deal is too good to resist,” the reformed shopaholic said.

“During a sale event in 2021, I accidentally bought two of the same Dyson vacuum cleaners – one on Shopee and another on Lazada. I didn’t even realise I bought the same product until both arrived. When you’re in the mood to shop, you can forget that you already bought it because there are so many purchases.”

But Lim has changed her habits since by being more “intentional” with her purchases, opting for hand-me-downs over new items and reducing waste wherever possible, all while documenting her journey and sharing tips on social media.

In a 30-second TikTok video posted two weeks ago, Lim shares how she maintains her underconsumption lifestyle, such as investing in simple or timeless clothes that outlast transient fashion trends and downsizing her wardrobe and shoe collection.

Her video is among thousands of social media posts celebrating frugality and romanticising conservative spending, with the “underconsumptioncore” hashtag garnering over 46.1 million views on TikTok.

For Lim, embracing the “underconsumption core” trend has opened up new avenues to reduce her carbon footprint and pursue a minimalist lifestyle although she acknowledges there is more that she can do and learn.

For many of her peers, the trend is a response to the rising cost of living, job uncertainty and lay-offs, which have forced them to reduce their spending, personal finance gurus say.

In South Korea, young Gen Z and Gen Y are bidding goodbye to their days of YOLO (“you only live once”) spending and prioritising saving amid high inflation and weak income growth rates.

Meanwhile, consumption of convenience store foods rose by 21 per cent and Starbucks purchases dropped by 13 per cent over the same period.

“When you combine rising prices with the fact that many youths are being retrenched in the latest spate of lay-offs, it is not surprising that people are starting to embrace the underconsumption core trend … for now,” said Dawn Cher, founder of SG Budget Babe, a finance blog, expressing scepticism that these habits would be ingrained among the youth of today.

But the trend could still normalise thriftiness and those tightening their pursestrings no longer have to fear being “the odd one out” or labelled as cheap, Cher said.

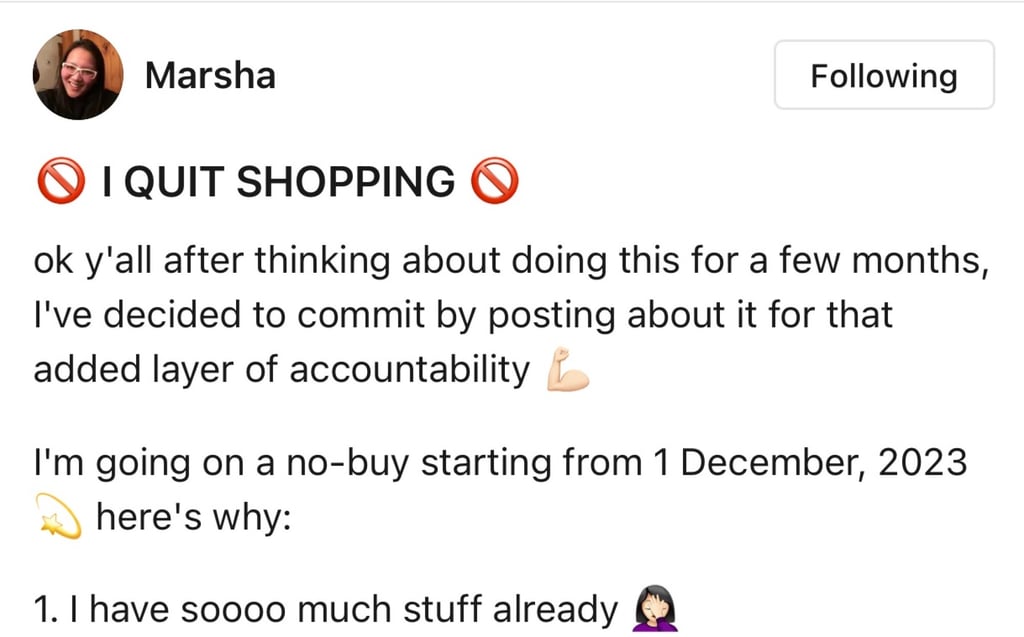

For Marsha Ho, 30, a civil servant, taking on a “low buy” challenge earlier this year has been a way to alleviate feelings of guilt over wastage and what she describes as “mindless” spending.

“I was just acting on every impulse, whenever it came. I would be happy after buying something but it would fizzle out quickly,” Ho said. “I realised that I was starting to get overwhelmed by my belongings and I didn’t want my stuff to make me anxious.”

Listening to tips from influencers on moderate shopping and decluttering has helped Ho to “rewire” her attitude on excessive buying.

According to NTU’s Elhajjarm, such social media posts help make the underconsumption concept more relatable for the uninitiated.

“Content creators share practical advice on how to live a more frugal and sustainable life. For example, videos on how to cook meals on a budget, DIY projects or capsule wardrobe ideas are popular. These educational videos make the concept of underconsumption accessible and actionable for young people,” he said.

If too many people cut back on spending, businesses might struggle

Economic impact

However, if underconsumption were to become mainstream, it could have implications for the broader economy, business experts say.

Elhajjar said: “Widespread underconsumption can slow economic growth as consumer spending is a significant driver of economic activity. If too many people cut back on spending, businesses might struggle, leading to job losses and further economic challenges. It’s about finding a balance between responsible consumption and economic vitality.”

But Tan from DBS expressed doubt that minimalism would be the standard thinking of young shoppers and as such, it would have a limited impact on the economy.

“Underconsumption or being a more conscious consumer can have benefits for their personal finances. Reduced spending can translate to more savings and the potential to channel cash surpluses towards investing to accumulate wealth,” she said.

Beyond matters of economics, Ho is glad that she has become more prudent with her shopping as it has freed up her home and mind.

“When I look at my closet, I don’t have so many regrets staring me in the face any more. I don’t have to feel bad whenever I open my closet because everything I have in there is stuff I like and feel excited to use.”