Asia Pacific’s largest asset owners, who represent the biggest concentration of capital among the world’s top 20 institutional investors, are strategically accessing new technology investments through established fund managers rather than direct investments, according to WTW’s Thinking Ahead Institute.

Jayne Bok,

WTW

“Large institutional investors tend to have relatively stable investment strategies and are less likely to take an adventurous approach,” Jayne Bok, head of investments Asia, WTW told AsianInvestor.

Since new investments typically take time to mature, it can also take some time for these opportunities to be reflected in the portfolios of these large funds, she added.

“Where they may see some exposure is through their allocations to third party managers in areas like private equity or venture capital where the managers are providing earlier stage or seed capital to new opportunities.”said Bok.

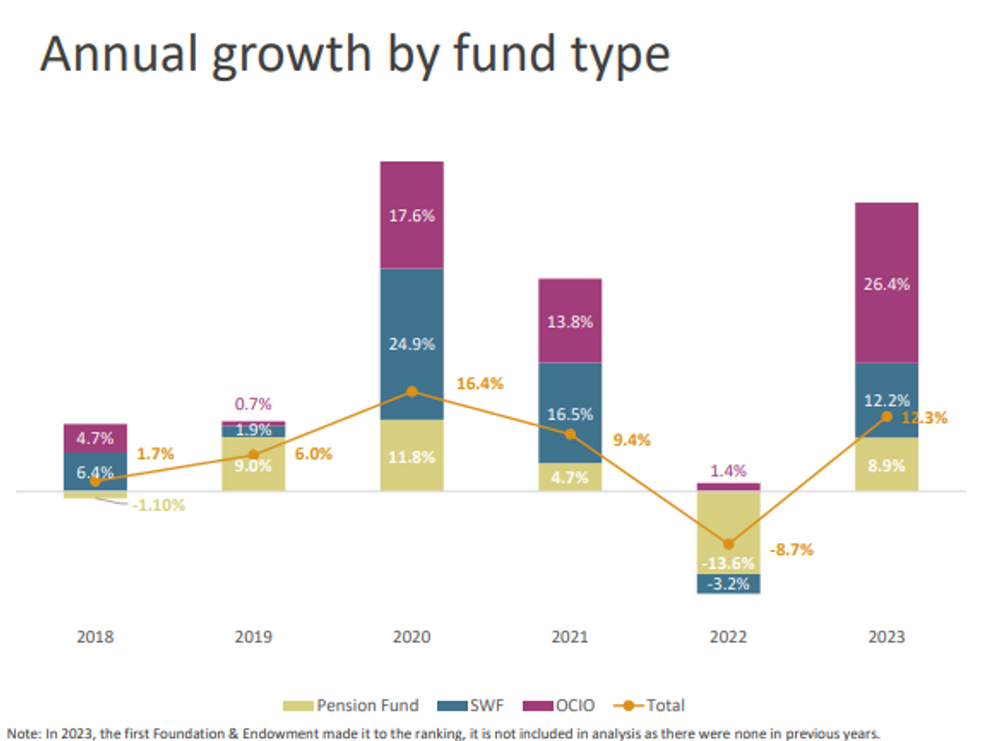

Source: Thinking Ahead Institute

The top 100 asset owners managed $26.3 trillion in assets at the end of 2023, with the top 20 accounting for 55.6% of the total. APAC institutions have dominated these rankings since 2017, though their share of the top 20 declined from 48% to 43% in 2023, according to the research.

“There are several very large SWFs in APAC and the top 20 asset owners has generally been very stable over the years,” said Bok.

They expect the trend of APAC’s dominance to continue because funds of that size will not be overtaken shortly, she added.

Meanwhile, outsourced investment managers (OCIOs) recorded the strongest growth among all categories, with a 26.4% year-on-year rise, though they represent just 9.3% of the top 100 asset owners’ total assets.

DEMOGRAPHIC SHIFTS

Investment strategies among Asia’s largest asset owners reflect the region’s contrasting demographic landscape, from Japan’s mature population to Southeast Asia’s youth-driven markets.

Particular demographic patterns affect both fund duration and investment priorities, explained Bok.

“For funds with a more mature membership, the duration is shorter, creating greater pressure on liquidity and stability, often with higher allocations in fixed income,” said Bok.

“Funds with younger memberships tend to prioritise growth, with equities playing a larger role in asset allocation,” she added.

Despite the distinct preferences between different age groups, Bok also stressed the importance of taking account of other factors to understand the investment market.

“That said, specific asset allocation strategies must be understood at the market or fund level,” mentioned Bok.

In the end, Bok believed that Japan pension fund still maintains relatively long durations as institutional investors.

This is exemplified by Japan’s Government Pension Investment Fund (GPIF), which remains the world’s largest asset owner with $1.6 trillion in assets, despite the country’s aging demographics.

GROWING INFLUENCE OF SWF

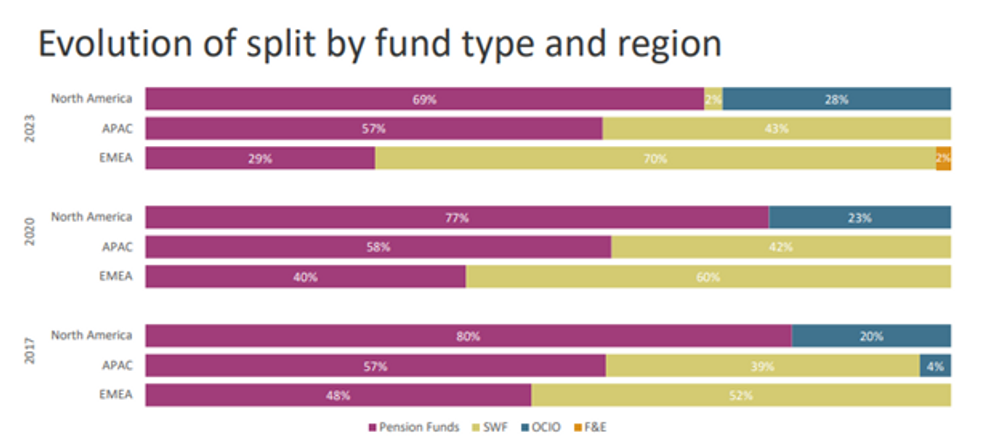

APAC sovereign wealth funds have expanded their global footprint, with their share rising from 39% in 2017 to 43% in 2023. Despite this growth, pension funds remain dominant in the region.

Source: Thinking Ahead Institute

“In many cases, pension funds in APAC are state-owned or government related making them somewhat sovereign in nature,” Bok further explained.

The areas where both might compete against each other are in alternatives and other return-seeking assets, she added.

“This is where they may compete more with SWFs given pension funds will generally have lower risk appetites that are linked to the maturity of their liabilities,” said the head.

“That said, as sizeable long-term investors with clear mandates, they are often able to forge long-standing and strategic relationships with asset managers and provide a degree of stability that is valued,” said Bok.

¬ Haymarket Media Limited. All rights reserved.