(Bloomberg) — Asian equity benchmarks were set to trade within tight ranges following a mixed day on Wall Street on speculation the tech sector rally may be running out of steam.

Most Read from Bloomberg

Futures showed Hong Kong and Australian equities may edge higher early Tuesday, while Japanese stocks looked flat. While various sectors outside the technology world advanced on Monday, Nvidia extended a three-day rout of about $430 billion — crossing the technical threshold of a correction. However, the chipmaker at the heart of the artificial-intelligence revolution remains up almost 140% this year and is still the most-expensive stock on the benchmark index.

The S&P 500 fell below 5,450. Energy and financial shares rose as tech retreated. The Nasdaq 100 lost over 1% after coming close to the 20,000 mark last week. Nvidia sank 6.7% Monday. A gauge of chipmakers dropped 3%, with 29 of its 30 stocks down. The Dow Jones Industrial Average outperformed.

“We remain concerned about a near-term unwind of many year-to-date leaders,” said Jonathan Krinsky at BTIG. “If the S&P 500 is going to avoid a bigger pullback into July, bulls need to see continued rotation below the surface.”

Treasury 10-year yields fell two basis points to 4.23% while Bitcoin slumped below $60,000 before rallying early Tuesday. Losses are piling up in the crypto market after its second-worst weekly decline of 2024, a reflection of cooling demand for Bitcoin exchange-traded funds and uncertainty over monetary policy.

In Asia, traders will be watching for further signs of pressure on the world’s second-biggest economy. Data released Monday showed China’s fiscal revenue shrank at the fastest pace in more than a year, fueling expectations that the government could make another rare mid-year budget revision to aid a recovery.

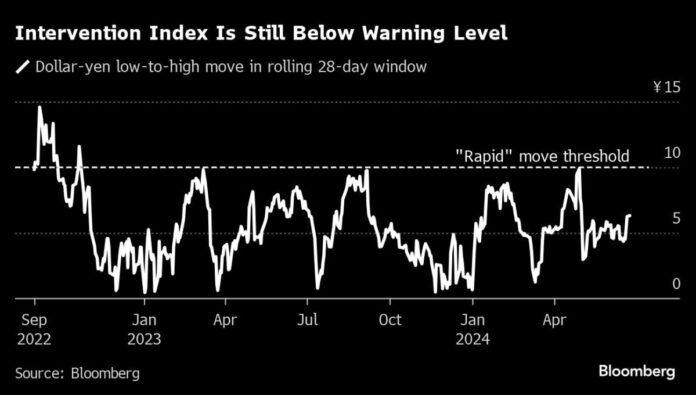

Elsewhere, Japan’s top currency official warned that authorities stood ready to intervene in markets 24 hours a day if necessary as the yen remained under pressure, not far from the weakest level in about 34 years.

In the US, more than a quarter of respondents in the latest MLIV Pulse survey plan to cut their stock holdings over the next month. That compares to 19% who expect to add exposure, and the gap between the potential sellers and buyers in the largest since October.

The S&P 500 is expected to close the year at 5,606, according to a median of 586 responses. That’s less than 3% above current levels, indicating that the rally has little left after a 14% gain so far in 2024. Additionally, almost half of survey participants expect a correction to begin later this year.

Oil climbed, with a softer dollar and rising tensions with Russia providing support. The easing greenback also helped gold erase some of Friday’s loss, edging up 0.3%.

Key events this week:

-

US Conference Board consumer confidence, Tuesday

-

Fed’s Lisa Cook, Michelle Bowman speak, Tuesday

-

US new home sales, Wednesday

-

China industrial profits, Thursday

-

Eurozone economic confidence, consumer confidence, Thursday

-

US durable goods, initial jobless claims, GDP, Thursday

-

Nike releases earnings, Thursday

-

Japan Tokyo CPI, unemployment, industrial production, Friday

-

US PCE inflation, spending and income, University of Michigan consumer sentiment, Friday

-

Fed’s Thomas Barkin speaks, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were little changed as of 7:29 a.m. Tokyo time

-

Hang Seng futures rose 0.5%

-

S&P/ASX 200 futures rose 0.5%

Currencies

-

The Bloomberg Dollar Spot Index fell 0.3%

-

The euro was little changed at $1.0734

-

The Japanese yen was little changed at 159.60 per dollar

-

The offshore yuan was unchanged at 7.2832 per dollar

-

The Australian dollar was little changed at $0.6656

Cryptocurrencies

-

Bitcoin rose 1.1% to $60,122.26

-

Ether rose 1.1% to $3,344.63

Bonds

-

The yield on 10-year Treasuries declined two basis points to 4.23%

-

Japan’s 10-year yield advanced 1.5 basis points to 0.985%

-

Australia’s 10-year yield was little changed at 4.22%

Commodities

This story was produced with the assistance of Bloomberg Automation.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.