PUBLISHED : 9 Nov 2024 at 09:12

RECAP: Asian equities pared an earlier advance yesterday as investors awaited the outcome of a key legislature meeting in China that is expected to approve more policy support to boost flagging growth.

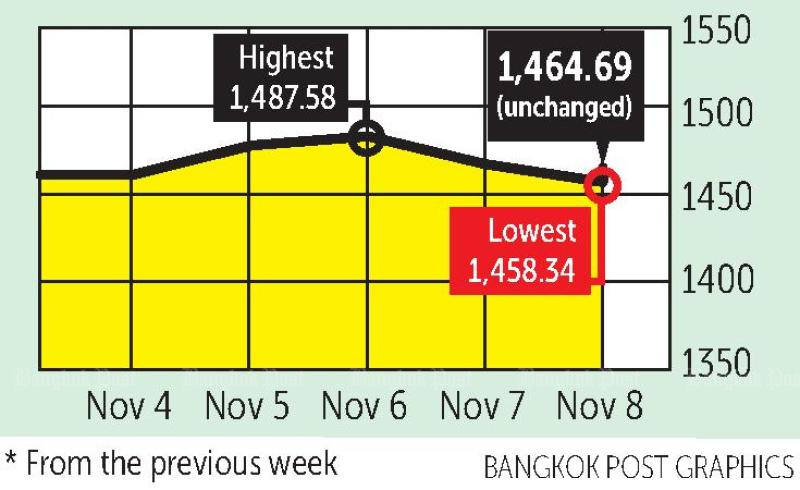

The SET index moved in a range of 1,458.34 and 1,487.58 points this week, before closing on Friday at 1,464.69, unchanged from the previous week, with daily turnover averaging 47.14 billion baht.

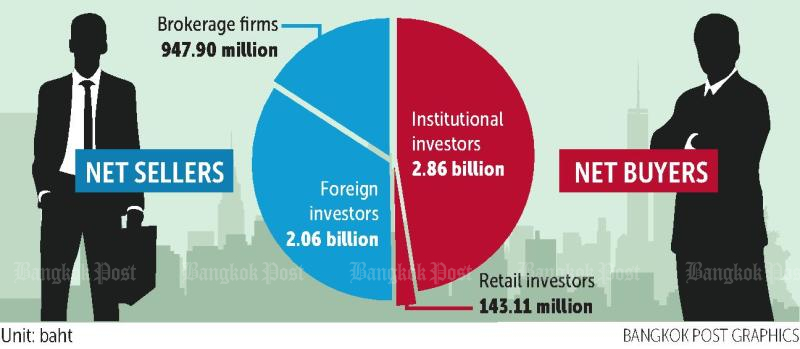

Institutional investors were net buyers of 2.86 billion baht, followed by retail investors at 143.11 million. Foreign investors were net sellers of 2.06 billion baht, followed by brokerage firms at 947.90 million.

NEWSMAKERS: The US Federal Reserve cut its key interest rate by another 25 basis points as expected, though the election of Donald Trump has led to reduced expectations for how much further rates will fall. Fed chairman Jerome Powell stressed, however, that policy decisions will depend on economic data, and the Fed won’t try to anticipate fiscal or trade policy.

- Votes are still being counted, but the Republican Party is close to keeping control of the House of Representatives. It now controls the Senate, improving the chances of Mr Trump getting legislation passed.

- The US services sector expanded at an accelerating pace in October, with the ISM Services purchasing managers’ index (PMI) rising to 56 from 54.9 in September.

- China’s top legislative body has approved a bill to allow local governments to issue 6 trillion yuan ($840 billion) in bonds to swap for off-balance sheet or “hidden” debt, as policymakers sought to spur the economy.

- Chinese exports surged last month at their fastest pace in more than two years. The dollar value of exports climbed 12.7% to $309.1 billion, the best since mid-2022.

- Chinese regulators have asked banks to lower the rates they pay on deposits from other financial institutions to free up funds to boost the economy, Bloomberg reported.

- The Bank of England lowered its interest rate by a quarter oint to 4.75% on Thursday, despite raising its inflation forecast for 2025 to 2.75% because of increased state spending and taxes. It said inflation would not return to its 2% target until 2026.

- Toyota Motor kept its annual net profit forecast unchanged, despite logging a 26% drop for the first half of the financial year. Net profit to Sept 30 was ¥1.9 trillion ($12.4 billion), down from ¥2.6 trillion a year ago.

- Nissan Motor shares slumped as much as 10% in Tokyo on Friday, a day after the Japanese automaker said it would cut 9,000 jobs and 20% of its capacity as it struggles with sales in China and the US.

- Honda Motor has raised its full-year sales forecast to ¥21 trillion ($136.4 billion) for the fiscal year ending in March 2025, from ¥20.3 trillion. However, first-half operating profit was ¥257.9 billion, well short of consensus estimates of ¥431.1 billion.

- German exports and industrial output dropped more than expected in September, with shipments falling 1.7% from the previous month. Industrial output fell 2.5%, compared with a forecast of a 1.0% decline.

- Shiseido Co slashed its profit outlook from ¥55 billion to ¥35 billion for the year as the Japanese cosmetics giant reported a profit plunge of 26% amid a persistent slump in the key Chinese market.

- The US private equity firm KKR has become the largest shareholder in the Japanese software developer Fuji Soft, with 90% of outstanding share options, after completing the first stage of a two-part tender offer.

- Sony Group said its net profit for the six months to September grew 36.5% from a year earlier to ¥570.13 billion ($3.7 billion), helped by robust sales of games and semiconductors.

- Several Chinese EV brands reported record-high deliveries in October, with BYD showing strong growth of 5.6% to 500,000 units, along with Xpeng and Geely, benefiting from Chinese government subsidies.

- Chinese EV sales in the European Union declined for the third month, falling 9.6% year-on-year in September, impacted by an increase in tariffs of up to 45%.

- SpaceX, controlled by billionaire Elon Musk, has asked Taiwanese suppliers to transfer some manufacturing off the island because of geopolitical risks, leading to some relocating portions of their supply chain.

- The Commerce Ministry is confident Thailand will benefit from Donald Trump’s presidency, expecting exports to the US to increase as they replace goods from China. The ministry hopes for 5% export growth and more foreign investment relocations to Thailand next year.

- Inflation in Thailand rose for a seventh consecutive month in October, up 0.83% year-on-year, driven by higher prices of food, diesel and electricity, the Ministry of Commerce said on Wednesday.

- The Finance Ministry expects GDP in 2024 to grow 2.7%, which it considers satisfactory in view of flooding in several provinces and delays in disbursing the 2024 budget. The government is currently considering some short-term stimulus measures.

- Thailand is targeting 8 million European tourists next year, up from 7.3 million last year, contributing to a new high of 11 million long-haul visitors, Tourism and Sports Minister Sorawong Thienthong said at the World Travel Market 2024.

- The Electricity Generating Authority of Thailand is conducting studies for three pumped-storage hydropower plant projects with a total capacity of 2,472 Megawatts and an electricity production cost of just 2 baht to support Thailand’s Net Zero target.

- The Stock Exchange of Thailand (SET) has cautioned investors about trading shares of Delta Electronics Thailand (DELTA), as a steady rise in the price, apparently unsupported by fundamentals, has pushed up the price-earnings ratio to 91.1 times.

- The Thai Bankers’ Association (TBA) has announced a debt restructuring programme covering borrowing of 1.4 trillion baht, aimed at alleviating household debt over three years. Interest payments will be suspended for selected vulnerable borrowers of home, auto and small business loans.

- The Government Housing Bank (GH Bank) says the housing price index in Bangkok and vicinity in the third quarter moved up due to the rising cost for land, labour and oil pushing up construction costs, suggesting prices will go up further next year.

- The selection committee choosing a new Bank of Thailand board chairman is expected to meet on Monday, after two postponements, as the government pushes for the appointment of former commerce minister Kittiratt Na-Ranong. Economists and former BoT chiefs say such a move looks like political interference.

- The Federation of Thai Capital Market Organizations’ investor confidence index for the next three months remains in the very bullish zone for the second month at 160.66, supported by government economic stimulus, an interest rate cut and tourism recovery.

- The Board of Investment has approved two major data centre projects worth over 60 billion baht. They are Google’s fifth data centre in Asia, due to open in early 2027, and a GDS International facility slated to open in 2026.

COMING UP: On Monday, the latest Japan Economy Watchers index will be released. Tuesday brings German inflation, UK unemployment and the monthly Opec oil market report. On Wednesday, the US and Russia will announce October inflation and Australia will update unemployment data.

- On Thursday, the UK will release GDP, trade and industrial production updates. The euro zone will reports quarterly GDP, the US will update producer prices, and Fed chairman Jerome Powell will speak. Japan will announce quarterly GDP and China will release industrial production and unemployment figures. Friday will bring US retail sales, industrial production and business inventories, and an EU economic forecast.

- Domestically, Thai Union Group on Monday will discuss its strategy through 2030. On Tuesday, WHA will discus its Industrial Leasehold Real Estate Investment Trust (WHAIR). On Wednesday, Aberdeen Asset Management (Thailand) will discuss investment strategy after the US election.

STOCKS TO WATCH: InnovestX Securities recommends stocks with high dividend yield and expected to be targets of the Vayupak Fund and tax-deductible funds. Such stocks usually have three characteristics: dividend yield of at least 3.5%, high SET ESG and corporate governance ratings, and earnings expected to grow. Interesting stocks are BBL, ADVANC, HMPRO and BCP. Look to buy on dips as prices have already moved up. Stocks benefiting from a weakening baht in the short term are TU and AOT.

- Asia Plus Securities says the Republican win in US elections will likely lead to a trade war that will pressure companies with production bases in China to relocate. That would benefit industrial estates, notably AMATA, ROJNA, WHA. Also recommended are shippers RCL and PSL, and transport stocks SJWD and WICE.

TECHNICAL VIEW: InnovestX Securities sees support at 1,450 points and resistance at 1,487. Kasikorn Securities sees support at 1,450 and resistance at 1,500.