China is reshaping the global arms trade—emerging as a major weapons supplier while shedding its historic dependence on foreign imports.

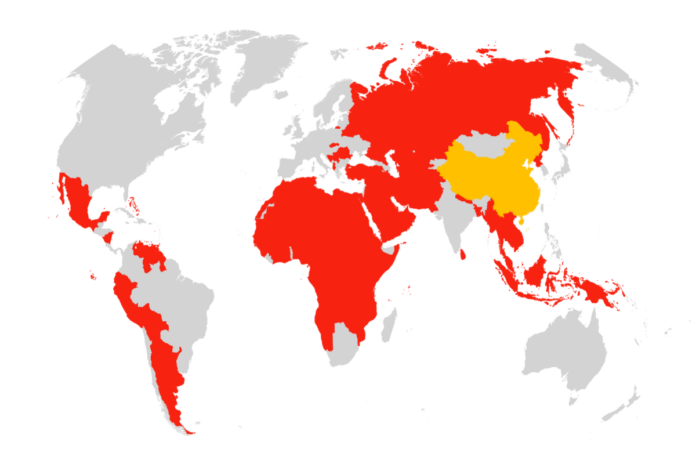

In recent years, Chinese-made drones, missiles, and fighter jets have been exported to 44 countries, from Pakistan and Myanmar to Nigeria and Algeria. A new report by the Stockholm International Peace Research Institute (SIPRI) confirms this transformation, as China ramps up domestic production and moves closer to defense self-sufficiency.

Last month, Pakistan claimed its Chinese-built jets had downed six Indian aircraft—including three French-made Rafales—in a brief but intense border skirmish. The clash was seen as a rare test of Chinese weapons against Western hardware.

Newsweek has reached out to China’s defense ministry for comment.

Why It Matters

China’s evolution from arms importer to exporter is not just an industrial feat—it is a tool of statecraft. Military sales build alliances, open diplomatic channels, and reshape power balances. Beijing’s strategy offers lower-cost weapons with fewer strings than Western suppliers, appealing to governments wary of U.S. oversight.

What To Know

According to SIPRI’s March, China’s arms imports fell by 64 percent between 2020 and 2024 compared to the previous five-year period. This dramatic shift reflects breakthroughs in local engine production, combat aircraft, and helicopters, ending decades of dependence on Russian and European technologies.

Newsweek‘s interactive map illustrates which countries are buying Chinese weapons and what systems are being sold.

China’s arms exports remain significant but increasingly concentrated. Pakistan is the largest buyer, accounting for 63 percent of China’s total arms exports between 2020 and 2024.

Beijing supplies Pakistan with fighter jets, naval vessels, drones, and air defense systems. Other buyers in Asia such as Bangladesh and Myanmar have acquired armored vehicles, trainer aircraft, and small arms.

In Africa, countries including Nigeria and Algeria import tanks, surface-to-air missiles, and unmanned aerial vehicles from China. In the Middle East, nations such as Iran and Oman have purchased Chinese drones and missile systems, although many others favor Western suppliers to maintain strategic alliances. Meanwhile, in South America, countries including Venezuela and Bolivia have acquired light weapons and military vehicles from China, seeking affordable alternatives to Western arms.

Limits on China’s Exports

Despite this global footprint, China’s arms trade remains regionally narrow. While its defense industry has grown, total exports declined by 5.4 percent from 2020 to 2024. Many nations—particularly in Asia and Oceania—are turning to Western suppliers instead, with India, Japan, Australia, and South Korea leaning heavily on U.S. sources to counterbalance Beijing’s military rise. Political alignment, rather than pricing or capability, continues to shape arms markets, leaving China reliant on traditional partners rather than expanding into more strategically influential regions.

VCG/AP Photo

What People Are Saying

Siemon Wezeman, Senior Researcher, SIPRI: “Arms purchases aren’t just about acquiring weapons; they also establish political and military alliances.”

Lyle Morris, Fellow, Asia Society Policy Institute: “This was a rare opportunity for the international community to gauge Chinese military hardware on the battlefield against Western (Indian) hardware.”

What Happens Next

China is poised to expand its presence in Africa, Southeast Asia, and among long-standing partners such as Pakistan. However, unless Beijing can overcome political resistance, its defense industry is unlikely to rival the global influence of American arms suppliers.

Sputnik/AP Photo